Pain Amortization

Mar 04, 2021

By: Nick Sienkiewicz, DPT, CSCS

Pay off your pain like you do your loans!

Pain is extremely complex. It is multi-factorial, so when trying to manage it, we must take a multifaceted approach. However, when dealing with complex scenarios, it can be overwhelming. Trying to find simplicity within complexity can be a helpful strategy to keep things in perspective.

As humans, we’ve all experienced pain at some point in our lives. And as adult humans in a modern day society, we’ve likely all taken on a loan or two. Since loans are a common occurrence, and generally understood by everyone, it can be helpful to make the analogy of loan repayment to rehabilitating your pain.

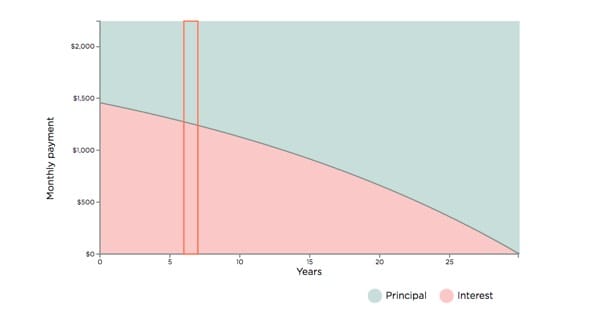

Loan amortization dictates the repayment schedule of the loan. Typically, you’re paying more interest early on with little principal, then toward the back end of the loan the scale is tipped the other way. Loans can vary in lengths of time, have different interest rates, and ultimately affect the borrower uniquely based on his or her individual situation. Similarly, everyone experiences pain differently. It can be acute or more chronic, and the factors that influence one’s pain are very much specific to that individual. Even though pain states can be very convoluted and chaotic, while the loan amortization process is very structured and regimented, we can draw on the parallels discussed in this blog to help people stay positive and motivated in their journey to resolve their pain.

- For the purposes of this blog, we’ll use “good times” to describe the asymptomatic times when your pain is decreased or negligible and you’re feeling more like your normal self. “Bad times” will refer to the symptomatic periods when pain is intensified, impacting your life and activities. For the record, I’m not a fan of saying good times and bad times, but the theme of this blog is simplification.*

In general, you start in debt (pain). Early on, you pay mostly interest (bad times) and very little principal (good times). As time goes on and you’re making payments (rehab, lifestyle changes), more money (change or progress) is put toward the principal. Similar to your pain state, the bad times typically outweigh the good times early on, but as you commit to your individualized plan, the good times gradually begin to last longer and longer, with shorter periods of bad times in between.

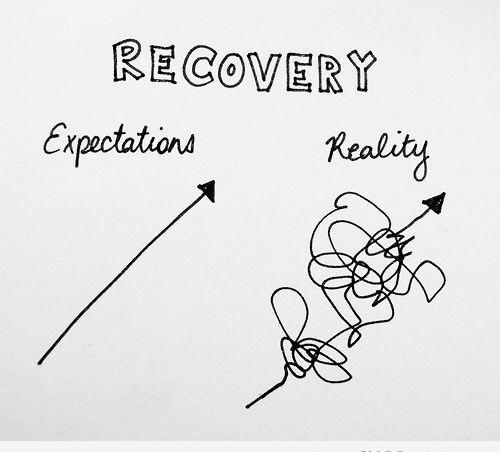

As you can see in this picture of a loan amortization schedule, we can look at the green as being the good times and the pink being the bad times with pain being the black curved line between the two colors. If we were to overlie an actual graph of someone’s pain experiences, the line would appear very much convoluted and tangled (like the reality line in the image below), but the general trend over the course of one’s rehabilitation would be toward improvement (hence the line trending upward).

This is the basic connection, but we could go deeper in the financial pain analogy. Consider a loan with a higher interest rate. This is a loan that is more difficult and frustrating to pay off. It is like the pain experience, such as the nagging tendinopathy, that takes more effort and time to manage. Next, think of a longer term loan, such as a mortgage. This is one where we have to frame our mindset early on to know that this payment will be a part of our bills for the foreseeable time. It does not mean you have to stop living and focus on that until it is paid off. It just means you have to be consistent with your payments. In a similar fashion, chronic pain, commonly seen in the low back, that has been present for years may be synonymous in that it will take more time to resolve, but does not mean you have to stop enjoying your recreational activities completely. The underlying theme here is that no matter how long and frustrating the loan or pain experience, you must keep making your payments. You do not want to default on your loan payments. If you struggle to make your rehab payments on your pain, it will likely make your pain resolution period more drawn out as well.

Many times, individuals who are in pain will often compensate for their movement in some way. These compensations are like credit. It allows you to do something for the time being, but you will always be required to pay it off. If you do not have the money to pay it off currently, you will ultimately owe more in the long run. This is not to say that all compensations are negative. Sometimes, you need to compensate in a certain way for a short period of time, like you may need to use credit at times throughout your life. However, when you do use credit or compensate, you must understand the trade offs so you can be an informed decision maker. Like the other comparisons, this is very individualized. Some people can afford to reach a higher credit limit while still being able to pay it off. Just as it is important to know your own financial situation to know what you can and cannot afford, you should learn about you body’s own physical and mental capacities and limits.

These parallels of resolving pain to paying off a loan are undeniable. Remember that pain is complex, and often not the result of direct or immediate tissue injury, but rather the output from a multitude of factors. Ultimately, it can be even more overwhelming once you understand this phenomenon, so attempting to simplify the situation can provide you with reassurance during your journey. In our current healthcare world, we have created a model where people are often left feeling like they have no control of their pain. The control is given to external factors, such as medication and other passive modalities. Unfortunately, this breeds a model of dependency. Therefore, I believe this concept of pain amortization can be extremely powerful to use when helping individuals through a certain pain state. It shows that, like with your loans, you are in fact in control of paying off your debts even when it may not feel that way!

Stay Connected With News and Updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.